Regulatory Business Model Stress-Test | FCA Application Challenge Premium

Prepare your FCA authorisation application for the scrutiny it will receive. This specialist-powered stress-test simulates FCA Case Officer questioning, identifies weaknesses in your Regulatory Business Plan, and generates a prioritised remediation roadma

Regulatory Business Model Stress-Test

Will Your Application Survive FCA Scrutiny?

The FCA rejects or returns 18% of applications because firms aren't "ready, willing and organised." Don't be one of them.

Our Regulatory Business Model Stress-Test simulates the challenging questions an FCA Case Officer will ask about your application - before you submit it.

What's Included

📋 Self-Assessment Workbook

Structured preparation covering Threshold Conditions, business model viability, SMF readiness, Consumer Duty compliance, and evidence gaps. Complete this before the analysis for maximum insight.

🤖 AI-Powered Stress-Test Analysis

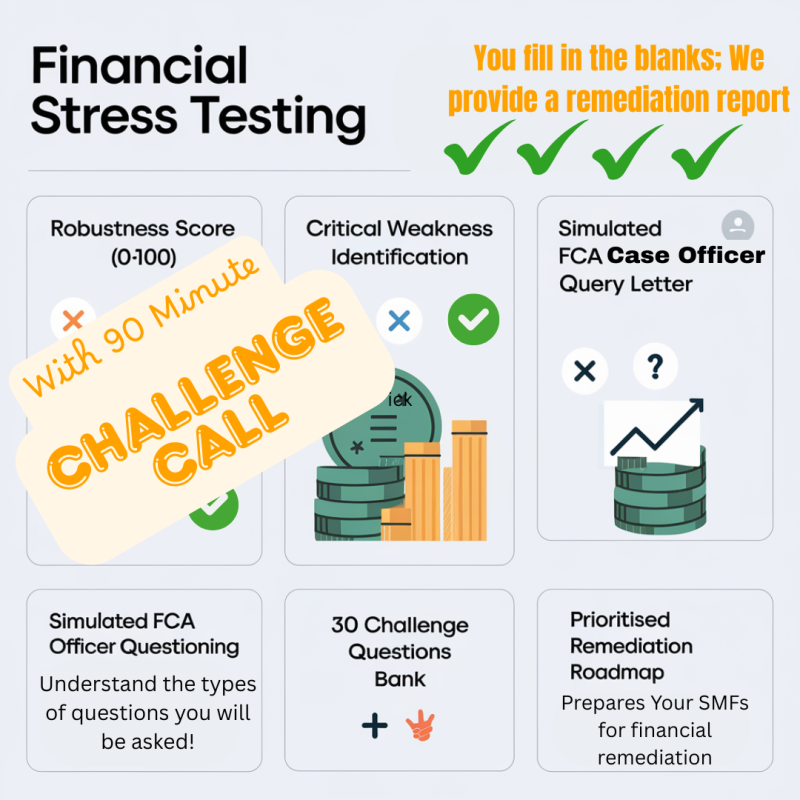

Upload your Regulatory Business Plan to our analysis engine. Receive a comprehensive Weakness Report with Robustness Score (0-100), RAG-rated findings, and prioritised remediation roadmap.

📧 Sample FCA Query Letters

4 authentic templates covering Business Model, Governance, Financial Resources, and AML queries. Familiarise yourself with regulatory tone and prepare your responses in advance.

🚩 Red Flag Indicators Guide

Firm-type specific indicators that mirror common FCA concerns. Know what triggers scrutiny before you trigger it.

❓ 30 Challenge Questions Bank

The exact questions FCA Case Officers ask, organised by theme. Use these to prepare your SMF holders for interview.

What You'll Receive

- Robustness Score (0-100) with interpretation

- Critical Findings - Issues likely to cause rejection

- Significant Findings - Issues that will trigger queries

- Moderate Findings - Areas attracting scrutiny

- Minor Observations - Best practice improvements

- Simulated FCA Query Letter - Bespoke to your application

- Remediation Roadmap - Priority matrix with timeline

Suitable For All FCA Firm Types

- Payment Services (API/SPI)

- E-Money Institutions (EMI/SEMI)

- Investment Firms

- Consumer Credit Firms

- Mortgage Brokers

- Insurance Intermediaries

- Claims Management Companies

- and more ...!

And, included is the Live Challenge Session (@£495 if booked within 72 hours of the report)

This will take your preparation further to the finish line with a 90-minute facilitated challenge session via video call:

- Real-time SMF holder interview practice

- Probing questions from an experienced regulatory consultant

- Recorded session for internal training

- Written action summary within 48 hours

Just want the Basic Package with no Experiential Insights? No Problem - CLICK HERE.

"The questions you struggle with in this session are the questions the FCA will ask. Better to struggle now than later."

Part of The Regulatory Assurance Advantage Series

VAT is added at checkout.

Affiliates

Like this product?

Spread the word about it and earn 50.00% of the purchase price on sales you refer.

Join our affiliate program